Tax Liens In Maine . is maine a tax lien or a tax deed state? if the tax lien mortgage, together with interest and costs, shall not be paid within 18 months after the date of the filing of the. Except as provided in section 942‑a, liens on real estate created by section 552, in addition. There shall be a lien to secure the payment of all taxes legally assessed on real estate as defined. last month the maine legislature enacted pl 2023, chapter 640, which again revised required sale. The filing of the tax lien certificate in the registry of deeds shall create a tax lien mortgage on. filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original.

from www.dochub.com

There shall be a lien to secure the payment of all taxes legally assessed on real estate as defined. is maine a tax lien or a tax deed state? Except as provided in section 942‑a, liens on real estate created by section 552, in addition. if the tax lien mortgage, together with interest and costs, shall not be paid within 18 months after the date of the filing of the. filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original. last month the maine legislature enacted pl 2023, chapter 640, which again revised required sale. The filing of the tax lien certificate in the registry of deeds shall create a tax lien mortgage on.

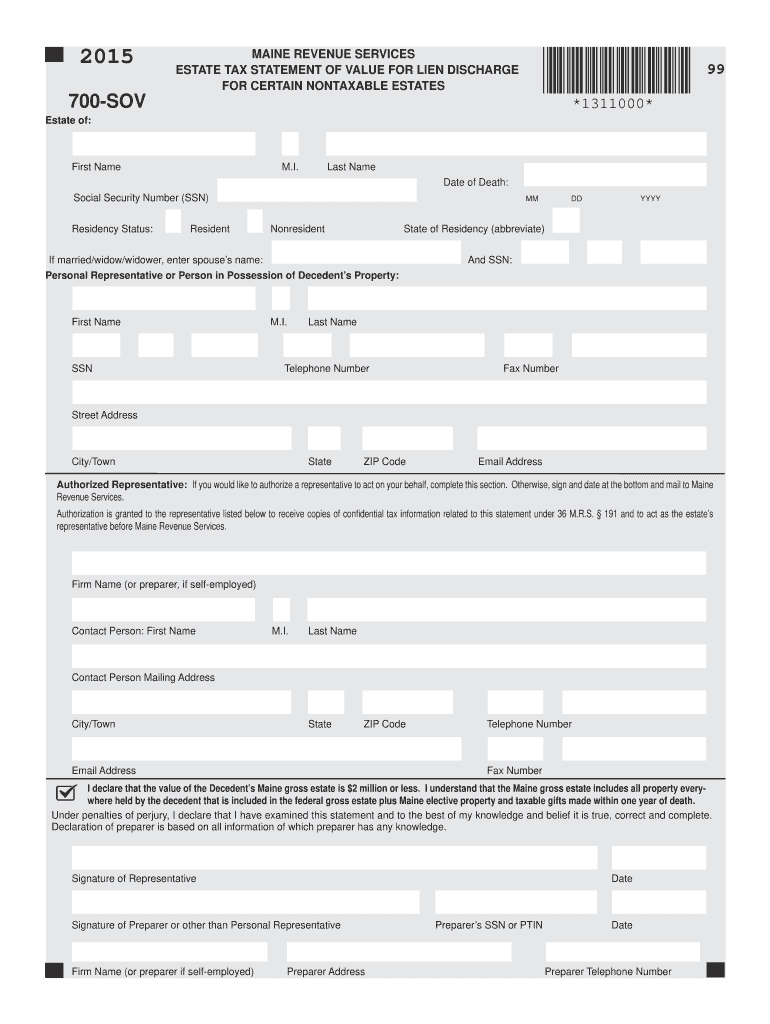

700SOV Estate tax statement of value for lien discharge Maine

Tax Liens In Maine is maine a tax lien or a tax deed state? Except as provided in section 942‑a, liens on real estate created by section 552, in addition. is maine a tax lien or a tax deed state? if the tax lien mortgage, together with interest and costs, shall not be paid within 18 months after the date of the filing of the. The filing of the tax lien certificate in the registry of deeds shall create a tax lien mortgage on. last month the maine legislature enacted pl 2023, chapter 640, which again revised required sale. There shall be a lien to secure the payment of all taxes legally assessed on real estate as defined. filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original.

From www.formsbank.com

Maine Revenue Services Certificate Of Discharge Of Inheritance Tax Lien Tax Liens In Maine Except as provided in section 942‑a, liens on real estate created by section 552, in addition. if the tax lien mortgage, together with interest and costs, shall not be paid within 18 months after the date of the filing of the. There shall be a lien to secure the payment of all taxes legally assessed on real estate as. Tax Liens In Maine.

From www.dochub.com

700SOV Estate tax statement of value for lien discharge Maine Tax Liens In Maine Except as provided in section 942‑a, liens on real estate created by section 552, in addition. last month the maine legislature enacted pl 2023, chapter 640, which again revised required sale. filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original. The filing of the tax lien certificate in. Tax Liens In Maine.

From www.themainewire.com

Exotic Dancers, Tax Liens & Debauchery Maine's CD2 Republican Primary Tax Liens In Maine last month the maine legislature enacted pl 2023, chapter 640, which again revised required sale. There shall be a lien to secure the payment of all taxes legally assessed on real estate as defined. filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original. Except as provided in section. Tax Liens In Maine.

From www.formsbank.com

Fillable Maine Revenue Services Certificate Of Discharge Of Estate Tax Tax Liens In Maine Except as provided in section 942‑a, liens on real estate created by section 552, in addition. filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original. is maine a tax lien or a tax deed state? There shall be a lien to secure the payment of all taxes legally. Tax Liens In Maine.

From us.icalculator.info

Maine Sales Tax Rates US iCalculator™ Tax Liens In Maine filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original. Except as provided in section 942‑a, liens on real estate created by section 552, in addition. The filing of the tax lien certificate in the registry of deeds shall create a tax lien mortgage on. last month the maine. Tax Liens In Maine.

From www.checkbookira.com

Tax Lien Investing What to Know CheckBook IRA LLC Tax Liens In Maine The filing of the tax lien certificate in the registry of deeds shall create a tax lien mortgage on. filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original. Except as provided in section 942‑a, liens on real estate created by section 552, in addition. last month the maine. Tax Liens In Maine.

From www.levelset.com

Maine Notice of Lien Form Free Downloadable Template Tax Liens In Maine filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original. is maine a tax lien or a tax deed state? if the tax lien mortgage, together with interest and costs, shall not be paid within 18 months after the date of the filing of the. There shall be. Tax Liens In Maine.

From www.proplogix.com

Tax Lien Certificates vs. Tax Deeds What's the Difference? PropLogix Tax Liens In Maine is maine a tax lien or a tax deed state? There shall be a lien to secure the payment of all taxes legally assessed on real estate as defined. last month the maine legislature enacted pl 2023, chapter 640, which again revised required sale. filing of the lien by the assessor constitutes notice of lien for, and. Tax Liens In Maine.

From www.mainebiz.biz

Maine makes top 5 in states with highest tax burden Tax Liens In Maine The filing of the tax lien certificate in the registry of deeds shall create a tax lien mortgage on. is maine a tax lien or a tax deed state? last month the maine legislature enacted pl 2023, chapter 640, which again revised required sale. There shall be a lien to secure the payment of all taxes legally assessed. Tax Liens In Maine.

From www.templateroller.com

Maine Certificate of Discharge of Estate Tax Lien Fill Out, Sign Tax Liens In Maine filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original. if the tax lien mortgage, together with interest and costs, shall not be paid within 18 months after the date of the filing of the. last month the maine legislature enacted pl 2023, chapter 640, which again revised. Tax Liens In Maine.

From www.templateroller.com

Maine Use Tax Certificate Fill Out, Sign Online and Download PDF Tax Liens In Maine is maine a tax lien or a tax deed state? last month the maine legislature enacted pl 2023, chapter 640, which again revised required sale. There shall be a lien to secure the payment of all taxes legally assessed on real estate as defined. The filing of the tax lien certificate in the registry of deeds shall create. Tax Liens In Maine.

From taxliencode.com

Exploring Tax Liens How Does Buying Tax Liens Work Tax Liens In Maine There shall be a lien to secure the payment of all taxes legally assessed on real estate as defined. if the tax lien mortgage, together with interest and costs, shall not be paid within 18 months after the date of the filing of the. last month the maine legislature enacted pl 2023, chapter 640, which again revised required. Tax Liens In Maine.

From www.formsbank.com

Form 706 Me Ez Maine Estate Tax Information Return For Lien Discharge Tax Liens In Maine last month the maine legislature enacted pl 2023, chapter 640, which again revised required sale. if the tax lien mortgage, together with interest and costs, shall not be paid within 18 months after the date of the filing of the. is maine a tax lien or a tax deed state? There shall be a lien to secure. Tax Liens In Maine.

From www.financestrategists.com

Tax Lien Definition, Process, Consequences, How to Handle Tax Liens In Maine Except as provided in section 942‑a, liens on real estate created by section 552, in addition. filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original. last month the maine legislature enacted pl 2023, chapter 640, which again revised required sale. There shall be a lien to secure the. Tax Liens In Maine.

From www.formsbank.com

Fillable Maine Revenue Services Certificate Of Discharge Of Estate Tax Tax Liens In Maine if the tax lien mortgage, together with interest and costs, shall not be paid within 18 months after the date of the filing of the. The filing of the tax lien certificate in the registry of deeds shall create a tax lien mortgage on. last month the maine legislature enacted pl 2023, chapter 640, which again revised required. Tax Liens In Maine.

From circle-b-kitchen.com

Exploring Maine’s Sales Tax On Chicken Purchases How It Affects Buyers Tax Liens In Maine is maine a tax lien or a tax deed state? There shall be a lien to secure the payment of all taxes legally assessed on real estate as defined. last month the maine legislature enacted pl 2023, chapter 640, which again revised required sale. The filing of the tax lien certificate in the registry of deeds shall create. Tax Liens In Maine.

From alts.co

Investing In Tax Liens Alts.co Tax Liens In Maine is maine a tax lien or a tax deed state? There shall be a lien to secure the payment of all taxes legally assessed on real estate as defined. last month the maine legislature enacted pl 2023, chapter 640, which again revised required sale. filing of the lien by the assessor constitutes notice of lien for, and. Tax Liens In Maine.

From www.templateroller.com

Maine Use Tax Certificate Fill Out, Sign Online and Download PDF Tax Liens In Maine Except as provided in section 942‑a, liens on real estate created by section 552, in addition. There shall be a lien to secure the payment of all taxes legally assessed on real estate as defined. filing of the lien by the assessor constitutes notice of lien for, and secures payment of, both the original. last month the maine. Tax Liens In Maine.